Searching for workers compensation insurance in California?

As a licensed contractor, securing the right coverage—whether full workers compensation insurance for employees or a low-cost ghost policy for sole proprietors with no employees—is essential to avoid CSLB penalties and win more bids.

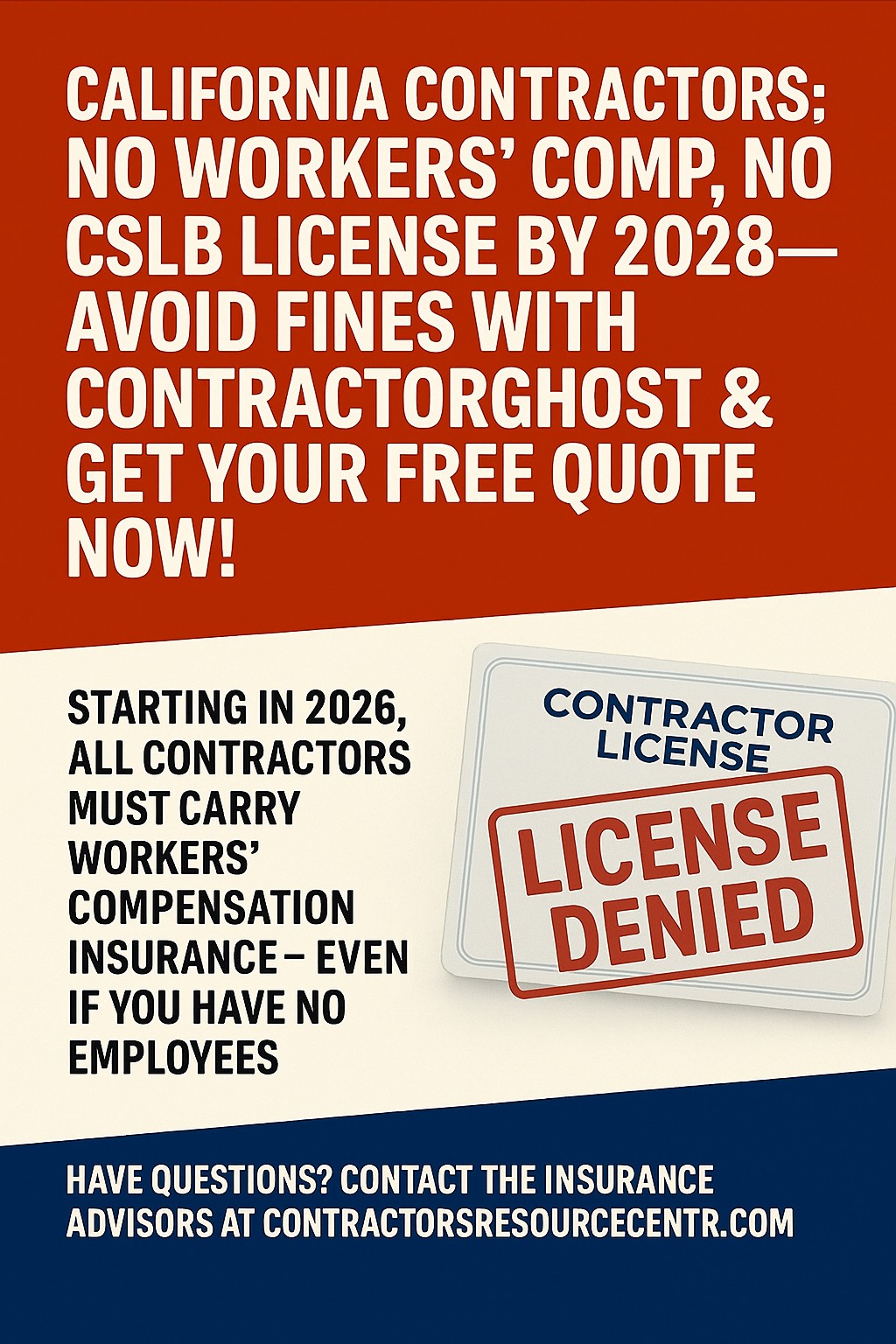

With Senate Bill 1455 extending SB 216’s full mandate to January 1, 2028, now’s the time to get compliant without breaking the bank.

At The Contractors Resource Center, we specialize in workers compensation insurance for California contractors, offering expert guidance as board members of the California Building Industry Association (CBIA) and regular attendees of CSLB Board Meetings.

What Is Workers Compensation Insurance for California Contractors?

Workers compensation insurance is mandatory for California contractors with one or more employees, providing essential protection against on-the-job injuries and illnesses. This includes coverage for medical expenses, temporary or permanent disability benefits, lost wages (up to state maximums), rehabilitation costs, and death benefits for dependents. It also safeguards your business from most employee lawsuits related to work injuries.

How Workers Compensation Insurance Premiums and Audits Work in California

- Premium Calculation: Determined by your total payroll, business location, employee job classifications, and past claims history—riskier trades like roofing or HVAC often mean higher rates.

- Annual Audit Process: Your insurer verifies actual payroll and subcontractor coverage against initial estimates. If exposure was lower, you get a refund; if higher (e.g., uncovered subs), expect an additional premium.

- Average Costs: For workers compensation insurance California contractors, premiums can range from 2–75% of payroll, depending on your classification.

Understanding Ghost Policy Workers Compensation: The Affordable Option for No-Employee Contractors

A ghost policy workers compensation—also known as a minimum premium or zero-payroll workers comp ghost policy—is a compliance-focused insurance product for sole proprietors, independent contractors, or paper general contractors (GCs) with no employees.

A workers compensation ghost policy can provide a contractor with a Certificate of Insurance (COI) to prove workers compensation coverage for bids and contracts, but provides no actual benefits or claim payouts since there’s no insurable payroll.

Key Benefits and Features of a Ghost Policy in California

- Eligibility for Workers Comp Ghost Policy: Must have zero employees and avoid restricted CSLB classifications (e.g., C-8 Concrete, C-20 HVAC, C-22 Asbestos Abatement, C-39 Roofing, C-61/D-49 Tree Service).

- Low-Cost Pricing: Ghost policy premiums range between $1,200 to $2,500 depending on your Class Code, Claims History, Location and a few other factors.

- Annual Audit: Confirms you still have no employees; if you hire, upgrade to full workers compensation insurance seamlessly.

- Why Choose ContractorGHOST? As experts in ghost policy for California contractors, we offer instant COIs and CSLB filings, ensuring you meet client demands without unnecessary costs while also keeping compliant with the CSLB licensing requirements.

SB 216 & SB 1455: Updated Workers Compensation Requirements for California Contractors (Extended to 2028)

SB 216 requires workers compensation insurance for all licensed California contractors, but SB 1455’s 2024 extension delays the universal mandate to January 1, 2028, while introducing verification starting in 2026.

Current Workers Compensation Insurance Rules (Through 2027)

- Provide a valid COI, self-insurance cert, or no-employee exemption.

- No exemptions if you have employees, a Responsible Managing Employee (RME), or restricted classifications.

- Process: File exemptions with CSLB—equated to a workers comp ghost policy for quick proof.

Stricter Mandates Starting January 1, 2028

- Universal Requirement: All contractors need workers compensation insurance unless in a verified no-employee joint venture.

- Verification System: Launching January 1, 2027, with audits, sworn statements, and potential site visits to validate ghost policy exemptions.

SB 216 Compliance Timeline for Workers Compensation Insurance and Ghost Policies

| Phase | Effective Date | Requirements | Impacted Classifications |

| Phase 1 | January 1, 2023 | COI or exemption mandatory | High-risk: C-8, C-20, C-22, C-39, D-49 |

| Verification Phase | January 1, 2026 | Audited renewals; proof required | All contractors |

| Full Mandate | January 1, 2028 | No unverified exemptions | All CA licensed contractors |

Risks of Non-Compliance: License suspension, fines up to $5,000, classification removal, and barred public bids. Our CBIA board role and CSLB meeting attendance keep us ahead—trust The Contractors Resource Center for proactive workers comp insurance strategies.

Workers Compensation Insurance vs. Ghost Policy: Side-by-Side Comparison for CA Contractors

| Feature | Full Workers Compensation Insurance | Ghost Policy Workers Compensation (e.g., ContractorGHOST) |

| Coverage Type | Comprehensive benefits (medical, wages, disability) | Proof of insurance only—no claims covered |

| Ideal For | Contractors with employees | Sole proprietors/no-employee GCs |

| Cost Estimate | 1–10% of payroll (varies by risk) | $100–$500 minimum premium |

| SB 216 Compliance | Full protection and proof | Exemption filing and COI for CSLB/clients |

| Audit Focus | Payroll verification & subs | Zero-employee confirmation |

| Best Use Case | Employee safety & liability shield | Bidding compliance & license renewal |

Choosing between workers compensation insurance and a ghost policy? It depends on your team size—start with ContractorGHOST and scale up.

Why The Contractors Resource Center Excels in Workers Compensation Insurance for California Contractors

As specialists in construction insurance for California contractors, we’re more than providers—we’re advocates. Our CBIA board membership shapes industry policies, while remote CSLB Board Meeting attendance delivers cutting-edge insights on workers comp laws. That’s why thousands trust us for ghost policy workers compensation like our proprietary ContractorGHOST: affordable, compliant, and contractor-focused.

Top Reasons to Partner With The Contractors Resource Center:

- Expert Workers Comp Insurance Quotes: Customized for your classification—get covered in days.

- Seamless Ghost Policy Setup: Instant exemptions and COIs to win bids fast.

- Proven Track Record: Help sole proprietors avoid SB 216 pitfalls and grow into full policies.

- Competitive Edge: Stay ahead of 2028 with insider knowledge.

Secure Your Workers Compensation Insurance or Ghost Policy Today—Free Quote for California Contractors

Don’t wait for CSLB audits or lost opportunities—protect your contracting business with ContractorCOMP or ContractorGHOST. Whether it’s full coverage or a simple ghost policy for contractors, The Contractors Resource Center makes compliance effortless. Contact us now for your complimentary consultation and workers compensation insurance quote. CLICK HERE

Questions? Contact Kevin at: