What is damage to premises rented to you and what does it cover?

Damage to Premises Rented to You coverage is a separate coverage tacked on to most general liability causes that give back a limited amount of coverage in the case of fire damage. If you cause a fire that damages your landlord’s property, this will kick in. It’s important to note this coverage only includes fire damage. The Damage to Premises Rented to You limit applies to situations where the negligence of the insured results in “property damage” to buildings or other structures it leases from a landlord.

Whether or not coverage applies for property damage liability to the rented premises depends on a number of factors. Examples of these factors are:

- whether the loss is caused by fire or something else, such as water damage from sprinkler discharge, broken skylight, or damaged floor;

- whether the loss is to rented contents, such as furniture or equipment, in addition to the building; or

- whether the rental is for a period of seven or fewer consecutive days.

What are the typical limits of coverage?

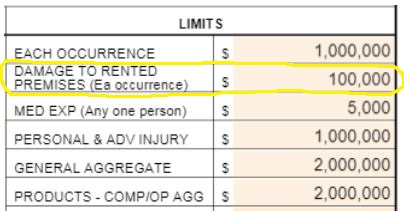

The majority of quality General Liability policies include “Damage to Premises Rented to You” coverage with a limit ranging from $50,000 to $100,000. For an additional cost, some insurance carriers will allow you to increase the limits of this coverage if needed.

Who needs this type of coverage?

If you rent space in commercial buildings, you likely need this coverage. In fact, many times coverage is required by the terms of the lease agreement. You will also want to consider this coverage if you have a pop-up or short-term (less than 7 days) event in rented spaces.

What’s the Bottom Line about this coverage?

This coverage is not intended to replace or act as primary property coverage on any building or space you rent. This means that the “Damage to Premises Rented to You” limits under your BOP (Business Owner Policy) or GL (General Liability) policy will only apply after all applicable property insurance coverage is exhausted. “Damage to Premises Rented to You” coverage applies only to damages for which you are determined to be legally liable. It does not apply to fire or other damage caused by acts of God or by other perils for which you are not legally liable.